At TW Solutions, we lead, staff, and deliver on your critical business transformation projects. Our hands-on advisory talent, once having served in leadership positions within PE backed, privately-held, and publicly traded companies, have significant operational finance experience bringing tailored solutions to your business needs.

Services

Solutions Services

Transformational areas of support

Record to Report

- Accounting process review & design

- Narratives/walkthroughs

- SOX compliance

- Close optimization

- Technical accounting

Financial Reporting

- Reporting process uplift

- Board/shareholder reporting

- SEC reporting

- Audit Readiness

Interim C Suite Leadership

- CFO

- CAO

Working Capital Optimization

- 13-week cash flows

- Cash management process optimization

- KPI reporting enhancements

M&A Support

- Sell side readiness

- Acquisition onboarding

- Purchase accounting

- CBS

- OBS

- NWC

- QoE

Need expert advice on navigating the complexities and opportunities in today’s finance and accounting world? Our Technical Insights articles are here to guide you.

A client had a lean accounting function with a Controller who had no experience in analyzing financial state data for quality of earnings (QoE) adjustments needed for sell side readiness. TW Solutions Director was engaged to perform the following functions:

General Ledger clean up

- Review GL detail for transactions that would qualify for QoE

- Interviewed management to obtain additional information on the nature of the transactions

Sell-side preparation

- Prepare detailed write ups on the nature of the transaction, why it qualified, and what period was adjusted for this amount

- Highlighted accounting transactions where the accounting treatment would change if acquired by a public company

- Prepared a high-level schedule of reconciliation of reported EBITDA to Adjusted EBITDA

- Used experience in other engagements to propose entries that management had not previously considered

Transaction support

- TW client utilized the results of this QoE project in the management deck for distribution to potential suitors. TW director was also hired to be a key member of the due diligence team on a consulting basis to manage the large number of requests and questions.

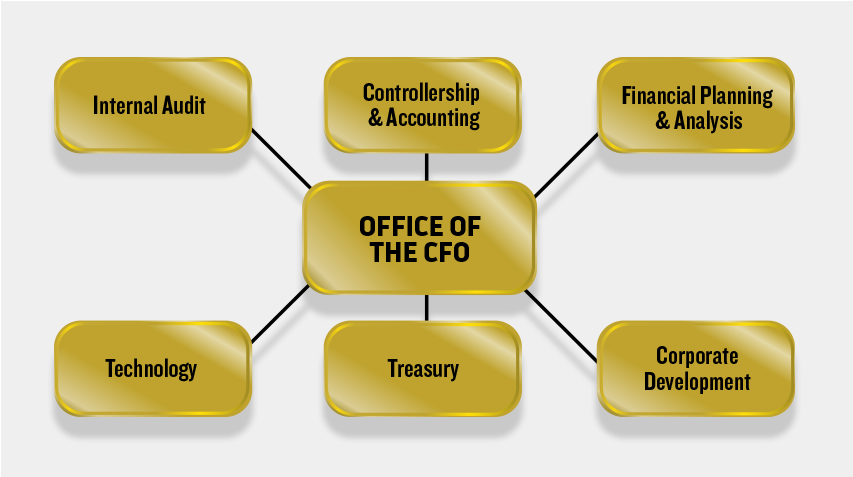

A financial sponsor ($3.3B AUM) was establishing a new enterprise via acquisition of a new platform company, while simultaneously acquiring (and integrating) two bolt-on acquisitions, with many future add-ons planned (eight total). We were asked to assist with: (a) creating the enterprise-level OCFO, (b) developing and executing the first-100 days financial integration plan, (c) providing execution resources to supplement existing teams and (d) identifying new processes/improvements to support the newly-designed organization.

Establish accounting foundation

- Convert all general ledgers from modified GAAP or cash basis to GAAP

- Recast closing balance sheets to reflect GAAP

- Create new processes (and documentation) for accounting staff

- Harmonize accounting policies and reporting processes

Properly account for the transaction

- Reconcile all NWC accounts, supported by audit ready account reconciliations

- Prepare the required NWC statements to the sellers as part of the final settlement of the purchase price

- Prepare Opening balance sheets supported by the valuation for all acquired assets and intangibles

- Provide technical memos supporting the Business Combination methodology for use by the auditors

Develop timely, accurate shareholder reporting

- Shorten the close cycle from 25 days to 5 days

- Harmonize general ledgers and financial reporting so all results were comparable

- Developed new reporting packages for lenders and PE

- Integrated an additional four add-on acquisitions over the next three months, one of which included a subsequent divestiture of a portion of the business acquired

Evaluate Talent and fill gaps

- Evaluated accounting and finance talent, wrote current job descriptions and interviewed successor talent

- Filled key Controllership and FP&A roles in interim capacity (approx. six months)

Optimize processes and enhance financial systems

- Centralized all the processing of accounts payable via implementation of Tipalti, a cloud-based payables automation solution that streamlined all aspects of the A/P and payment management workflow in the cloud

- Implemented a new accounting consolidation tool, Fathom, to simplify management reporting and financial analysis using existing ledger systems

TW Solutions hired a new CFO at a distributor that was recently purchased by a new private equity firm. Private equity firm had concerns as to the depth of experience of the accounting /finance team that the new CFO was charged to address.

Target balance sheet review

- TW Solutions recommended a balance sheet review project with an experienced director and senior as “consultants” to help the team get “audit ready”

- Interviewed existing staff including controller to assess skillset, use of technology and knowledge of business

- Performed a risk assessment to target high level areas of risk in an eight-week project

- Reviewed existing balance sheet account reconciliations for targeted areas

- Found journal entries recorded with no support documentation

- Identified lack of training on accounting system and use of excel

Stabilization and training

- TW client utilized the results of the short-term solution to expand the project to address all balance sheet accounts. New reconciliation formats were created by TW, and staff were trained to take over. New formats were utilized in the annual audit and reduced audit fees.

- Out of period adjustments were presented to the private equity firm in Quality of Earnings format. Recommendations also included hiring new permanent employees that were necessary for the company to support acquisitions and future growth.

Existing SaaS based organization was looking to sell. Prior to engaging bankers, the Company realized that there needed to be significant improvement in historical financial reporting, making the creation of and updates to their Confidential Information Memorandum (CIM) a more efficient activity.

TTW EBITDA

- Adjustment to G/L financials for out of period adjustment and reclassification of expenses between Cost of Goods Sold and SG&A

- Develop one-time adjustment items schedule and create a bridge from Net Income to Pro Forma EBITDA

- Create interface to the financials to update model each quarter

Revenue Reporting

- Enhanced reporting between recurring, non-recurring, and service-related revenues contemplating that each type had a different multiple attached to it

- Created top 25 customer analysis (3-year look back) with narrative on meaningful changes between years

- Created line of business gross margin analyses

- Developed recurring revenue projections, contract backlog analysis, contract renewal statistics, and deferred revenue waterfalls

Expenses

- Review of SG&A expenses to strip out any business owner expenses

- Critical review of all contract rebate clauses to ensure compliance with GAAP

- Adjustment to realization of advertising and marketing expenses

- Capitalization of certain sales commissions

Interim CFO needed for a multi-national manufacturing Company. Prior CFO had no advanced critical initiatives nor had sufficient insight into free cash flows. PE firm looking for an experienced CFO to step-in while they were conducting a retained search, coordinate Big 4, first time audit, create scalability, and enhance cash flow management.

Organization analysis and realignment

- Redesign of the accounting and finance function inclusive of adding an Asia Regional Controller to oversee five, in-country finance managers spread throughout Asia

- Upskill worldwide team on GAAP compliance and G/L reporting consistencies

- Lead audit readiness activities to support first-year, Big 4 audit including inventory roll back activities

Enhance reporting tools

- Conducted RFI for new EPM solution. Prior reporting was done out of excel and often contained formula errors and unintended changes to formats/reports.

- Evaluated vendors and software products, ultimately selecting Planful as the tool of choice, offering the ability to close and report monthly results on an accelerated basis, to have consistent formatting across the business units, and to allow for enterprise budget scenario and workforce planning.

- Established a 13wk cash flow forecasting process for improved monitoring of global net working capital

- Revamped monthly reporting deck to the PE sponsor and bank for more insightful analysis into the business

Evaluate talent and fill gaps

- Redesign of the accounting and finance function – moving from a decentralized to a regional aspect

- Created and hired an Asia Regional Controller to oversee five, in-country finance managers spread throughout Asia, with a focus on upskilling and GAAP compliance

- Established a new Corp Controllership function at the US HQ office for consistency in cost accounting and G/L reporting

- Started search for newly created FP&A manager to oversee budgeting and reporting