NEW ASU ALERT!

Effective for December 31, 2024 Financial Statements

FASB ASU 2024-03: Enhanced Expense Disclosures

The Financial Accounting Standards Board (FASB) has issued ASU 2024-03, introducing significant changes to expense disclosure requirements that demand your immediate attention.

Effective for fiscal years ending after December 15, 2024, this standard requires companies to provide more detailed and transparent breakdowns of significant expenses. For companies presenting comparative financial statements, it also means reclassifying prior-period data to align with the new disclosure format.

This article is your guide to understanding and implementing ASU 2024-03 efficiently.

This Article Will…

- Explain the key requirements of FASB ASU 2024-03, including the need for more granular disclosures about significant expenses.

- Provide practical examples of how to adjust your financial reporting, with before-and-after disclosures for clarity.

- Detail actionable steps companies can take now to prepare, including revising the chart of accounts, engaging teams, and reclassifying prior-year data.

- Clarify materiality thresholds and where the enhanced disclosures should appear (footnotes vs. face of financials).

- Offer guidance on handling missing prior-year data, with tips for leveraging existing systems and performing reasonable allocations.

This guide is designed to help CFOs and finance teams navigate the changes efficiently, ensuring compliance while enhancing the quality of their financial reporting.

What It’s About:

ASU 2024-03 enhances transparency in financial reporting by requiring companies to disclose more granular details about their significant expenses. This standard impacts almost all companies with a calendar year-end of December 31, 2024, and demands deeper insights into expense drivers, offering stakeholders better visibility into cost structures and trends.

For companies presenting comparative financial statements, this also means reclassifying prior-year data (e.g., December 31, 2023) to align with the new disclosure requirements. Importantly, these are considered reclassifications for comparative purposes, not a restatement (“Big R” or “little r”).

Key Changes in Disclosure Requirements:

Significant Expense Categories

Companies must disclose detailed components of significant expenses, such as employee costs, inventory costs, and contract-related costs.

Example Disclosure Before ASU 2024-03:

“Cost of goods sold for the year ended December 31, 2023, was $20 million.”

Example Disclosure After ASU 2024-03:

“Cost of goods sold for the year ended December 31, 2024, included:

- $12 million in raw material costs

- $5 million in labor costs

- $3 million in overhead and other production expenses”

Nature vs. Function of Expenses

Companies must specify whether they classify expenses by nature (e.g., salaries, depreciation) or function (e.g., COGS, administrative expenses). This classification helps stakeholders understand not only what the expenses are but how they contribute to the company’s operations.

Example Disclosure Before ASU 2024-03:

“Total selling and administrative expenses for the year ended December 31, 2023, were $15 million.”

Example Disclosure After ASU 2024-03:

“Selling and administrative expenses for the year ended December 31, 2024, included:

- $7 million in employee salaries and benefits

- $4 million in advertising and marketing costs

- $2 million in depreciation and amortization

- $2 million in travel and office-related expenses”

Expanded Narrative Explanations

ASU 2024-03 requires companies to go beyond simply reporting numbers by explaining significant changes or unusual trends in their expenses. These narrative explanations are crucial for helping stakeholders understand the “why” behind the figures, offering greater transparency and insight into the factors driving your financial results.

Example Disclosure Before ASU 2024-03:

“Total employee-related expenses were $10 million in 2023.”

Example Disclosure After ASU 2024-03:

“Employee-related expenses increased to $12 million in 2024, primarily driven by:

- A $1.2 million increase in salaries and benefits due to a 10% growth in headcount in sales and marketing.

- A $500,000 increase in training and development programs launched during the year.”

Materiality and Percentage Guidelines

ASU 2024-03 does not prescribe a specific percentage for breaking out expenses. Instead, companies are expected to assess materiality based on:

- Quantitative Factors: Many companies consider expenses representing 5-10% of total operating expenses as material.

- Qualitative Factors: Breakouts may also be required for items critical to operations, highly volatile, or non-recurring, even if they are below quantitative thresholds.

Presentation Requirements: Face vs. Footnotes

One of the key considerations under ASU 2024-03 is determining where the enhanced expense disclosures should appear—on the face of the financial statements or in the footnotes. Here’s what you need to know:

Where to Present the Details:

- Footnote Disclosures: The enhanced breakdowns of expenses are required in the notes to the financial statements, not on the face of the statements.

- Face of Financials: Companies may continue to present aggregated line items (e.g., “Selling and Administrative Expenses”) on the face of the statements.

Example Footnote Disclosure

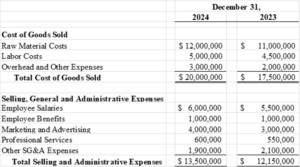

The following is an example of how to structure a compliant footnote disclosure under ASU 2024-03. This format includes a breakdown of significant expense categories by function and provides the necessary detail in the narrative to meet the standard’s requirements.

Note X: Expense Breakdown

The following table provides a breakdown of significant expense categories for the year ended December 31, 2024:

The following provides additional context for the significant changes and trends reflected in the expense breakdown for the years ended December 31, 2024, and 2023:

Cost of Goods Sold (COGS):

- Raw Material Costs: Increased by $1,000,000 (9.1%) compared to the prior year, driven by rising commodity prices and increased production volume to meet higher customer demand.

- Labor Costs: Increased by $500,000 (11.1%), primarily due to wage rate adjustments and additional staffing in the manufacturing division.

- Overhead and Other Expenses: Increased by $1,000,000 (50%), reflecting higher utility costs and facility maintenance expenses incurred during the year.

Selling, General, and Administrative Expenses (SG&A):

- Employee Salaries: Increased by $500,000 (9.1%) due to headcount growth in the sales and marketing teams and annual salary adjustments.

- Employee Benefits: Remained consistent with the prior year, reflecting stable healthcare costs and retirement plan contributions.

- Marketing and Advertising: Increased by $1,000,000 (33.3%), driven by expanded digital advertising campaigns and additional sponsorships to support a new product launch.

- Professional Services: Increased by $50,000 (9.1%), reflecting higher legal and consulting fees related to compliance initiatives and strategic planning projects.

- Other SG&A Expenses: Decreased by $200,000 (-9.5%), primarily due to cost-saving measures implemented in office operations and reduced travel expenses.

Additional Footnotes for ASU 2024-03 Adoption

Here are additional footnotes that should be included related to the adoption of ASU 2024-03. These disclosures would typically appear in the Summary of Significant Accounting Policies section of the financial statements to address changes in presentation and compliance with the new standard.

Reclassification

Certain prior-period amounts have been reclassified to conform to the current period’s presentation under ASU 2024-03, which was adopted by the Company as of December 31, 2024. These reclassifications had no impact on previously reported total operating expenses, net income, or cash flows.

New Accounting Pronouncements

In March 2024, the Financial Accounting Standards Board (FASB) issued Accounting Standards Update (ASU) 2024-03, “Enhanced Expense Disclosures”, which requires detailed disclosure of significant expense components and additional clarity when expenses are classified by function. The Company adopted this ASU as of December 31, 2024. In accordance with the guidance, prior-period amounts have been reclassified to conform with the current period’s presentation.

The adoption of this ASU did not have an impact on the Company’s consolidated balance sheets, statements of operations, or statements of cash flows. However, the presentation of expenses in the notes to the financial statements has been updated to provide the required level of detail.

What to Do if You Don’t Have Comparable 2023 Information

Preparing for ASU 2024-03 can be particularly challenging if your 2023 financial data wasn’t captured at the level of detail now required for disclosure. Comparative financial statements demand consistency between reporting periods, but companies often find themselves without granular historical data to align with the new standards.

Fortunately, there are practical steps you can take to bridge this gap, ensuring your prior-period financials are reclassified appropriately without compromising accuracy or transparency. Here’s how to approach the process effectively.

- Leverage Existing Data Sources: Use payroll systems, procurement logs, or expense management tools to reconstruct missing data.

- Engage Departments: Work with HR, procurement, and operations to gather additional historical data.

- Perform Reasonable Allocations: Use logical, consistent methodologies to estimate details for prior-period classifications.

- Document the Process: Record assumptions and allocation methods to ensure transparency with auditors.

Why This Works

This approach ensures compliance by permitting reasonable estimates for transactions recorded before the ASU’s implementation, while providing a structured path to meet disclosure requirements:

- Leverages Available Data: Makes use of available records to meet disclosure requirements.

- Focuses on Materiality: Targets significant expense categories, avoiding unnecessary detail and effort for immaterial items.

- Permits Reasonable Estimates: Offers flexibility for situations where granular historical data may not have been captured.

- Ensures Transparency: Clear documentation of assumptions and methods provides a defensible basis for disclosures, fostering auditor and stakeholder trust.

- Preserves Integrity of Financial Statements: Reclassifications align prior-period results without implying errors in previously issued statements.

Wrap-Up: Taking Proactive Steps for Compliance

While the requirements of ASU 2024-03 may seem daunting, taking proactive steps now—reviewing expense classifications, collaborating across teams, updating your chart of accounts, and preparing draft disclosures—can streamline compliance and ensure a more efficient financial reporting process and year-end close. By addressing these changes early, companies can position themselves for a smoother transition and enhanced transparency in their financial statements

Next Steps:

- Prioritize areas that require immediate attention, such as revising the chart of accounts and drafting enhanced disclosures.

- Collaborate across teams to address gaps in data for prior periods.

- Engage your auditors early to validate your approach and ensure alignment.

With preparation and focus, you can meet the requirements of ASU 2024-03 efficiently and effectively, ensuring a smooth transition to the enhanced reporting requirements.